Pay Down Your Mortgage More Strategically

Feb 28, 2023

When considering how to pay down a mortgage more quickly, we have to look at the interest rates and the true cost of the extra payments required. Interest rates are just "jobs" for your dollars. Whether analyzing debt or investment, creating a structure that flows your dollars to the best job is vital.

The Typical Advice

For example, in personal finance, we are often told to pay down a mortgage as quickly as possible to reduce the interest cost we pay on the mortgage. But does this actually make financial sense?

Let's look at paying down a mortgage on a $1M house. After the $200k down payment, that's an $800k mortgage.

At 3%, over 30 years, the monthly payment is $3,373 and the total interest paid will be $414,220. Including the $200K down payment, a total of $1.4M will be paid on a $1M house.

What if we do what we've been taught by the financial experts of the world and start putting additional cash flow toward paying down the principal of the mortgage?

Instead of $3,373/mo, let's pay $4,000/mo, the extra going toward paying down the principal of the loan.

By doing this, we paid off the loan about 7 years early and reduced our interest cost by about $100k, from $414,220 to $310,422.

Unfortunately, this is where the analysis on paying down a mortgage stops for most people and most financial advisors.

Comparing Equal Time Frames

The problem with this analysis is that it compares one financial outcome (interest paid) over two different time periods (23 years vs 30 years). What happens with that cash flow over the next 7 years, meaning the full 30 years?

Because the mortgage is paid off, we now have $4,000 of freed-up cash flow that we can now start saving 7 years earlier! If we use a conservative growth rate of 4% on that savings, that's $378,562 at the end of 30 years.

By paying down the mortgage faster then saving the freed up cash flow, instead of having just a house in 30 years, we have that same house + $379,000. Pretty good!

We gave our money a 3% job (paying down the mortgage) for 23 years, then gave the money a 4% job for the next 7 years.

So it's even better than what the financial experts have told me? Yes and no.

It is better. However, the analysis of what we did here is still incorrect. We just compared the same 30 years, but we compared different cash flows ($4,000 vs. $3,373). The correct way to compare this is to compare $4,000 in total outflows for 30 years in both scenarios.

Let's look at what happens if we compare:

The scenario we just ran (paying $4,000/mo until the mortgage is paid off, then saving the same $4,000/mo for the remaining 7 years)

Vs.

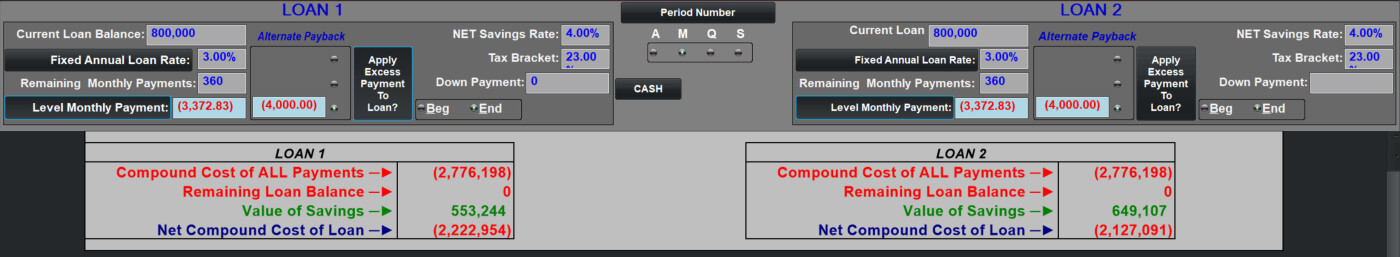

Paying the mortgage down, as scheduled, and saving the difference ($627), every month, at 4% for the entire 30 years.

When we do this, at the end of 30 years, we end up with the same house + $435,285 - an additional $56,723 over paying down the mortgage then saving.

Did we pay more interest on the mortgage? Yes. But do we care about that if, net of interest, we end up $57,000 ahead?

In this scenario, our scheduled mortgage payment went to the 3% "job" of paying down the mortgage for an additional 7 years (the full 30 years, as scheduled, rather than only 23 years). However, our surplus cash ($627) went to a 4% "job" for a full 30 years, rather than only the last 7 years as in scenario 1. The additional 23 years of compounding at 4% created a better outcome than the 7 years at 3% saved.

This is a 15% improvement over the status quo way of thinking.

But there is still more to the story!

Tax Deductions

Don't we get a tax deduction for mortgage interest? If we are paying down this mortgage principal every month, doesn't that reduce the interest portion of each payment going forward? While this is, of course good on one hand, on the other hand, it reduces our deduction as well.

When we pay down the mortgage principal we have a double-whammy working against us: we are prioritizing a lower interest rate "job" and that job is actually lowering one of the only tax deductions most W2 employees ever get. Instead, we could be directing extra cash flow to a higher-order "job" (4% instead of 3%) that also maximizes the tax deduction.

When we do this, our efficiency bumps up to around a 17% increase in wealth compared to paying down a mortgage early.

When we calculate this move as net compound cost, we have a 4% improvement. That's like creating a 4% per year tailwind behind us as we fly through our financial lives.

I wonder where you could get ultra-safe, liquid, tax-deferred 3-5% growth on your savings… I don't know, maybe dividend-paying whole life insurance?