Professional Life Insurance Planning Services in the Bay Area

Protect your greatest asset: You

During your working years, life insurance planning services should focus on replacing your income.

Many people are surprised to learn that your ability to earn an income is the greatest asset your family has.

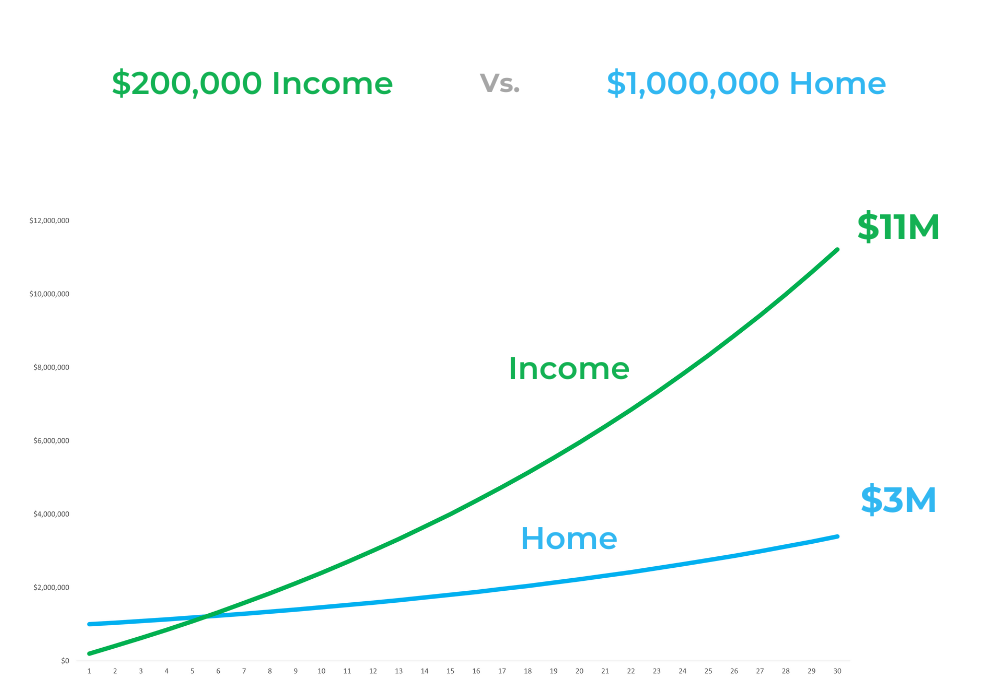

One simple example: compare a $200,000 income increasing at 4% annually to a $1,000,000 home appreciating at the national average of 4% annually.

No one would give a second thought to fully insuring the value of their home. Why should it be any different when insuring their life?

Start Today

A "Permission Slip" to Spend

During the retirement years, whole life insurance gives you the ability to replace the value of your assets.

When you have a permanent death benefit, everyone wins.

The life insurance premiums you paid bought a "permission slip" to use and enjoy all of your other assets while you're still alive, knowing the full value or those assets will be replaced by your guaranteed, tax-free death benefit.

Start TodayCreate More Value All Along the Way

While whole life insurance cash value provides roughly 40x the growth of a typical big bank, the policy loan provision offers safe leverage to buy additional assets.

This is why whole life insurance is often called "The 'And' Asset." You can buy life insurance *And* buy investments with the cash value.

This unique capabilities of whole life insurance allow every dollar in your system to do more than one job at the same time.

This is what The Infinite Banking Concept® is all about.

Start TodayWhy Choose StackedLife?

Located in the San Francisco Bay Area, StackedLife is Authorized Infinite Banking® and works nation-wide. We specialize in life insurance plans that make everything you're already doing in your financial life even better. No total overhaul of your finances is required.

We will help you accomplish three things:

- Protect your income so your family never has to lower their standard of living.

- Replace the value of your other assets, and the taxes paid on them, so you have more to use and enjoy while you're still alive.

- Expand your system to create more equity, income, and estate value.

LET'S TALK

Schedule a Consultation

Schedule a free 30 minute initial consultation, via web meeting or phone call.